Car insurance is required by law in some form in almost all U.S. states. Each state has its own specific rules about what type of coverage is required and how much. And each state is considered either an at-fault state or a no-fault state.

Learn more about no-fault insurance and exactly what each no-fault state requires from registered drivers.

What is no-fault insurance?

No-fault insurance states require drivers to file claims for bodily injury or medical expenses with their own insurance company, regardless of who was at fault in an accident. In contrast, tort, or at-fault states, require the driver at fault to submit claims for all parties involved.

In a no-fault state, you’re required by law to purchase a certain amount of personal injury protection insurance. PIP insurance covers things like deductibles, medical bills, lost wages due to injury, and even funeral expenses if necessary. It does not cover any damage to vehicles or other property caused by a car accident. The amount of PIP insurance required by law depends on the state.

No-fault insurance states

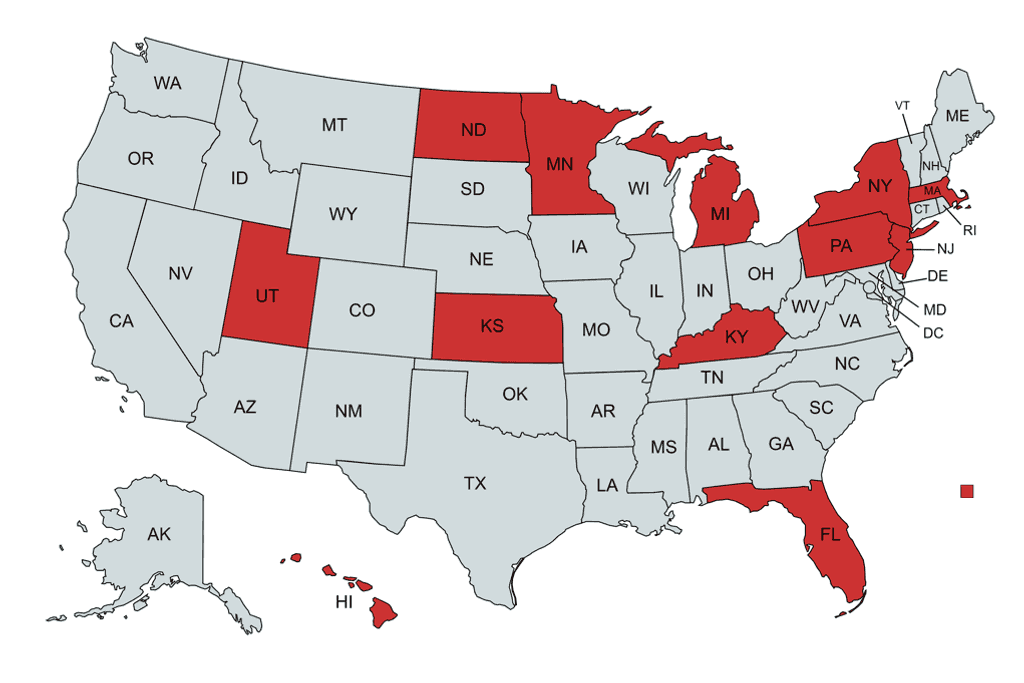

There are 12 states in the United States that are considered no-fault states: Florida, Hawaii, Kentucky, Kansas, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. Puerto Rico is also no-fault. Here are the PIP requirements in each of these states. (More on verbal vs. monetary thresholds later.)

| No-fault state | Requirements |

|---|---|

Florida | PIP insurance of $10,000; held to a verbal threshold |

Hawaii | PIP insurance of $10,000; held to a monetary threshold |

Kentucky | PIP insurance of $10,000 per accident; held to a monetary threshold. In Kentucky, you may reject no-fault insurance in writing. |

Kansas | PIP insurance of $4,500 per accident; held to a monetary threshold |

Massachusetts | PIP insurance of $8,000 per person; held to a monetary threshold |

Michigan | PIP insurance varies depending on how much health insurance the driver has; held to a verbal threshold. Michigan also requires drivers to carry a minimum $1 million in property protection insurance (PPI) |

Minnesota | PIP insurance of $20,000 per accident and $20,000 of loss of income per accident; held to a monetary threshold |

New Jersey | PIP insurance of $10,000 per accident |

New York | PIP insurance of $50,000 per person; held to a verbal threshold |

North Dakota | PIP insurance of $30,000 per person; held to a monetary threshold |

Pennsylvania | PIP insurance of $5,000 per person; held to a verbal threshold |

Utah | PIP insurance of $3,000 per person; held to a monetary threshold |

Puerto Rico | PIP insurance of $3,000 |

How do no-fault laws affect car insurance coverage?

The requirement to take out PIP insurance means car insurance coverage in no-fault states often costs more than in at-fault states. Additionally, the fact that you are responsible for paying for damages and repairs after an accident means you’ll have to make a claim on could make your premiums go up.

Negligent drivers are not held as liable in no-fault states as they are in tort states, because they don’t face as much of an insurance penalty. In a tort state, the negligent driver would be required to pay both for their own medical expenses and those of the other driver and any others involved. This may encourage safer driver behavior.

What’s not covered by no-fault insurance?

No-fault insurance only covers bodily injuries caused to you and the other driver and passengers in an accident. It does not pay for repairs to either vehicle or any other property that was damaged by the accident. For these repairs, the at-fault driver needs to make a claim on their insurance.

Theft is also not covered by no-fault insurance. In order to make a claim due to theft or to make repairs to a vehicle or other property, you will need to also take out collision and comprehensive car insurance in addition to the PIP insurance.

Frequently asked questions

Can you sue in a no-fault state?

If you’re involved in an accident in a no-fault state, you can still sue an at-fault driver but with certain limitations. Some states allow injured parties to sue if their injuries meet descriptions of seriousness set by the state; this is called “verbal threshold.” Others allow you to sue if the medical bills resulting from the accident exceed a certain amount; this is called “monetary threshold.” See the table above for a list of verbal and monetary thresholds per state.

In a tort state, there are no limitations regarding lawsuits for car accidents, which means you’re more likely to be sued by the other party if you caused the accident.

Three no-fault states — Kentucky, New Jersey, and Pennsylvania — allow drivers the option to choose between no-fault or at-fault insurance. If you opt for an at-fault policy, you can circumvent the threshold rules in these states and sue the other driver even if the injuries or medical bills involved don’t meet the state’s required verbal or monetary thresholds.

Whose insurance pays in a no-fault accident?

No-fault states require each driver to file a claim for injuries with their own insurance, regardless of who was at fault and caused the accident. But when it comes to auto or property damage, the at-fault driver is the one whose insurance pays for repairs.

Does a no-fault claim affect insurance?

Like all insurance claims, a no-fault claim can make your insurance premiums go up. Some insurance companies offer accident forgiveness for claims under a certain dollar amount, so make sure you ask about that when shopping around for insurance providers.

Do any at-fault states require PIP insurance?

Four states — Arkansas, Delaware, Maryland, and Oregon — require drivers to have PIP insurance even though they are not no-fault states. That means you may be required to pay your own medical expenses AND be sued for additional medical expenses by the other driver if you were found at-fault in the accident.

Summary

There are two types of state in the U.S. when it comes to car insurance: no-fault and tort/at-fault. It’s important to know what kind of state you live in so you can make sure your insurance coverage is enough as required by law. A local insurance agent can help you find the right policy for your state’s requirements and for your budget.

*Map created with mapchart.net