A car insurance declarations page is a summary of the coverage and other details contained in your auto insurance policy. It provides an outline of the policy’s details.

What is an insurance declaration page?

The declarations page for an insurance company provides a concise, summary level overview of your policy.

The declaration page for your car insurance policy is generally the first page of the policy when it’s issued to you. It is a summary of the policy including your coverage level, the premiums, the length and term of the coverage and other information about the policy.

What does one look like?

The car insurance declarations page is a summary of your coverage and as such almost looks like an outline. There are different sections in the declarations page with key pieces of information contained under these category headings. These might be things like a listing of the covered drivers and vehicles, policy limits, coverage types, etc.

How to get an insurance declaration page

The declarations page will usually be attached to your car insurance policy, often right at the front of the policy. If you don’t receive a copy with your copy of the policy you can contact your insurance agent or the insurance company.

You should also be able to access the declaration page of your car insurance policy online via your insurance company’s website or it’s app by logging in and accessing your policy.

Which Information is listed on the car insurance declarations page

The declarations page of an automobile insurance policy will provide a summary of the important information contained in your car insurance policy typically including:

Policy number

Generally the policy number will be displayed prominently at the top of the declarations page. This will be needed if contacting the insurance company about your policy, including making a claim if needed.

Policy period

This includes the term of coverage under the policy. The policy’s effective date is the date that coverage begins and the date that it ends. The policy period will tell you how long your coverage is in effect and when you will need to renew coverage by. Typical policy periods are six or twelve months. Temporary car insurance can cover you for shorter periods.

Drivers listed on the policy

The declarations page will list the drivers who are included as covered under the policy. The policy might also list any drivers who are specifically excluded from coverage as well.

Other relevant parties

The declarations page will also include the name and phone number of the insurance agent who you purchased the policy from, as well as similar information for the insurance company who issued the policy.

If there is a loan on the vehicle or if you are leasing the car, the name and contact information for the lienholder or the company from whom you’ve leased the car will be listed. This might be a bank, a credit union or another financial institution. In the event the car is totaled in an accident, the lien holder or the lessor would typically be paid off first.

Vehicle information

Each vehicle insured under the policy will have basic information including make, model and year. Additionally the vehicle identification number (VIN) for each vehicle covered under the policy will be listed.

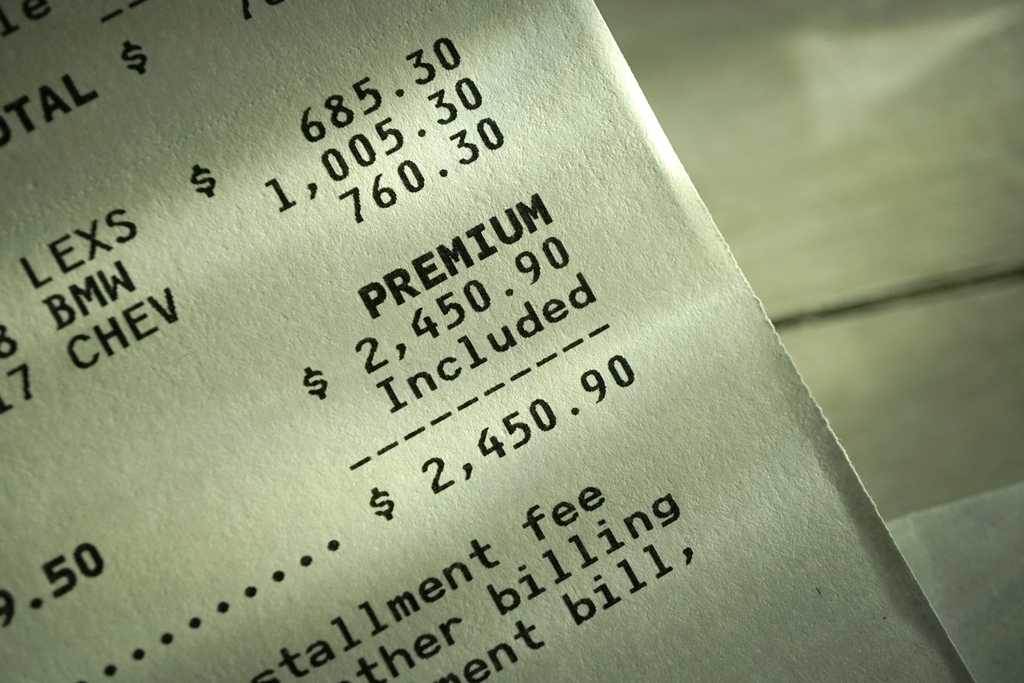

Premiums and deductibles

The declaration page will include premium information. If there are multiple vehicles on the policy the premium attributable to each vehicle will be listed. Premiums are determined by the amount of coverage you need, the age and repair/replacement cost of the vehicle and your driving record.

Deductibles are also listed. Policy deductibles represent the amount that the insured pays out of pocket before the coverage kicks in.

Coverages and limits

The types of coverages included in the policy and coverage limits will be listed on the declaration page. Coverages could include:

- Liability coverage is coverage for property damage or bodily injury that a driver causes to another driver or someone’s property.

- Personal injury protection covers medical expenses due to injuries that you may cause to yourself or to passengers in your vehicle in an accident.

- Collision insurance covers damage to your car in an accident.

- Comprehensive coverage takes care of repair bills incurred in a non-auto accident situation such as a riot, weather related damage or damage that occurs if your car is stolen.

- Underinsured/uninsured motorist coverage pays for damages to your car or medical bills from an at-fault driver who is not insured or whose insurance coverage is inadequate to cover your damages or injuries.

- Gap insurance kicks in when your car is stolen or totaled in an accident and the comprehensive coverage on your policy is not enough to pay off the lien holder or the company from whom you leased the vehicle.

Frequently asked questions (FAQ)

When will I need my auto insurance declarations page?

A common situation where you might need a copy of your auto insurance declarations page is when you are purchasing a new vehicle. Contacting your auto insurance company, putting the new car on the policy and having the company send you an updated declarations page by fax or as an email attachment can provide you with the proof of coverage you may need to provide the auto dealer to be able to drive your new car off the lot.

Is the declaration page proof of insurance?

It is more common to use your insurance card as proof of auto insurance. Most companies will send you one or you can also print an insurance card from the company’s site. It’s generally suggested that you keep a copy of your insurance card in your vehicle’s glove compartment in case you are pulled over by a police officer.

The policy declarations page can substitute as proof of insurance in some cases. It is best to check with your state and/or locality to be sure.

What is the difference between a certificate of insurance and a declaration page?

In the case of an auto insurance policy, your certificate of insurance is typically the insurance card the insurance company supplies to you when you initially take out the policy or renew coverage. This is generally accepted as the certificate of insurance or proof of coverage.

The declarations page is essentially a summary page for the coverages under the policy and other details. While it can be used as proof of insurance coverage, that is not the purpose of an auto insurance declarations page.

If I bundle home and auto do I have a separate declaration page?

Bundling home and auto together does not mean that you combine these policies as far as the coverages offered, but rather that you purchase them in a bundle or some sort of combination to get a price break.

Each type of policy will have its own declarations page outlining the separate coverage terms offered by each policy.