An SR-22 is not actually insurance but a form that your car insurance company files with your state. It proves that you have car insurance with at least the minimum level of coverage required by law. You may need an SR-22 to get your driver's license reinstated if you’ve had a serious traffic violation.

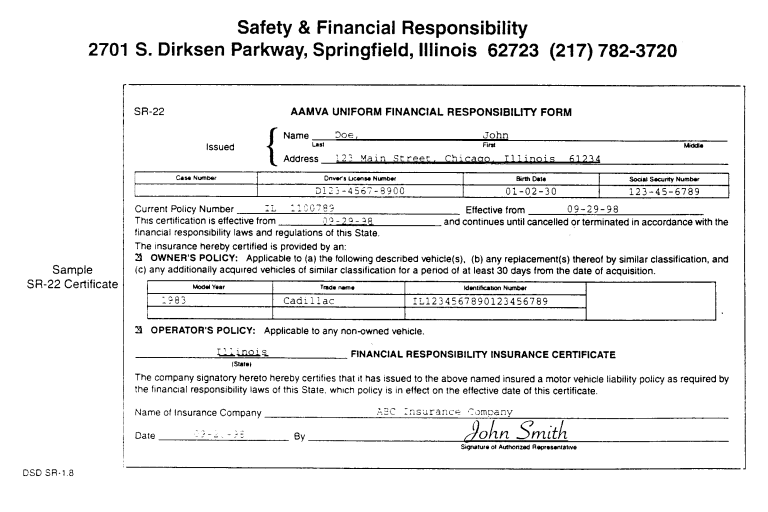

An example of a full form one can be seen here.

Who needs an SR-22?

An SR-22 may be required by a court or your state’s department of motor vehicles if any of these apply:

- You were convicted of driving under the influence of alcohol or other substances

- You had a serious traffic offense, such as reckless driving or excessive speeding

- You had numerous traffic offenses in a short period

- You were at fault in an accident in which you had no insurance

- Your driver's license was suspended or revoked for any reason

To put it plainly, you’ll know if you need an SR-22. If ordered by a court, the judge will tell you during your sentencing. If required by the state, you can expect to receive a notification in the mail.

SR-22 requirements

Most states require drivers to have an SR-22 for one to three years, though some have longer terms.

If you maintain a clean driving record while you have an SR-22, your requirement will likely end when the term is over. If you commit another serious traffic violation while you have an SR-22, then you'll probably be required to have it for a longer term.

If you move to another state while you have an SR-22, be sure to check with the new state’s requirements. In many cases, you’ll need to keep the filing in the original state. Some states require extra fees, additional insurance, or may require a new SR-22.

How much an SR-22 costs

An SR-22 will affect the cost of your insurance in two ways.

First, your insurer will charge you to cover the cost of the state filing fee. This fee is minimal, usually in the range of $15-$50. You pay it only one time unless your policy lapses and you have to get a new policy.

An SR-22 will have a far more severe impact on your car insurance rate. Because an SR-22 indicates that you're a riskier driver, you might see your rate increase by several hundred dollars. You may even need to shop for an insurance policy from another company, as some insurers will not provide policies to those needing an SR-22.

If the cost impact of an SR-22 is too severe, you might consider checking with other companies. Some companies specialize in coverage for high-risk drivers, and they typically offer coverage for those needing an SR-22. So shop around using the web or phone, or check with an independent insurance agent who represents multiple companies and can do the shopping on your behalf.

How to get an SR-22

Apart from the cost and the possible need to shop for an insurance company specializing in high-risk drivers, an SR-22 is easy to get. If you’re buying a new insurance policy online, the company will ask if you’re required to have an SR-22. If you need to add an SR-22 to an existing policy, contact your insurance company directly.

The insurance company will take things from there, preparing the SR-22 and filing it with the state. The insurance company will also bill you for the filing fee. If you have any questions, contact the insurance company.

Bottom Line

Needing an SR-22 means you've made a mistake behind the wheel and that you can expect to pay more for insurance. But it’s not the end of the world. Follow all the instructions in your court order, keep a clean driving record, and eventually the requirement will expire. In the meantime, arm yourself with knowledge of what an SR-22 is, its requirements, and how to get one if you need it.

Frequently asked questions (FAQ)

How long do I need to have an SR-22?

State SR-22 requirements generally range from 3 to 5 years. One state, Alaska, can require a driver to carry an SR-22 for up to 20 years.

What is SR-22 insurance?

An SR-22 is not actually insurance, but a form your insurance company files with the state to prove that you have at least the minimum required liability coverage.

What’s the difference between SR-22 and regular insurance?

Other than the filing and the added cost, an SR-22 is the same as regular insurance. You'll have the same coverage choices and be able to file a claim as any other policyholder would.

Can I get an SR22 when I don't own a car?

Yes, if you’re required to have an SR-22, you need to get it even if you don’t own a car. If you rent or borrow a car and get into an accident, you will still be liable for any injuries or property damage you cause.

If you need an SR-22 and don't own a car, contact your insurance company or agent about non-owner coverage. This policy provides only liability coverage and recognizes that you do not own a car. An SR-22 can be added to this kind of policy.

What’s the difference between an SR-22 and an FR-44?

Two states, Florida and Virginia, use a filing called FR-44. An FR-44 requires drivers to carry higher liability limits on their policy but is otherwise very similar to an SR-22.