If you are financing your vehicle with an auto loan, you have what’s called a lien. The loan provider, also called the lienholder, allows you to borrow the money under the condition that your vehicle is used as collateral. Until you repay the loan, the lienholder owns your vehicle and can take ownership of it if you fail to pay back the money.

The topic of loans, liens, and lienholders can be confusing. But if you have a car loan, it’s important to understand these terms and know how they work. In this guide, we’re going to explain everything you need to know about lienholders, including how a lien affects your car title and car insurance, and how you can add and remove a lien from your policy.

What Is a Lienholder?

A lienholder is a third-party that has lent you money to finance a big purchase (in this case, a vehicle) and legally owns the property until you repay the loan. Lienholders are typically banks, credit unions, or other financial institutions, but a lienholder can also be a private party.

A lien gives your lender the legal right to sell the vehicle if you fail to pay back what you owe. A lien is not the same thing as a loan, which is simply the amount of money you are expected to repay the lender (the principal plus interest).

What is a car title?

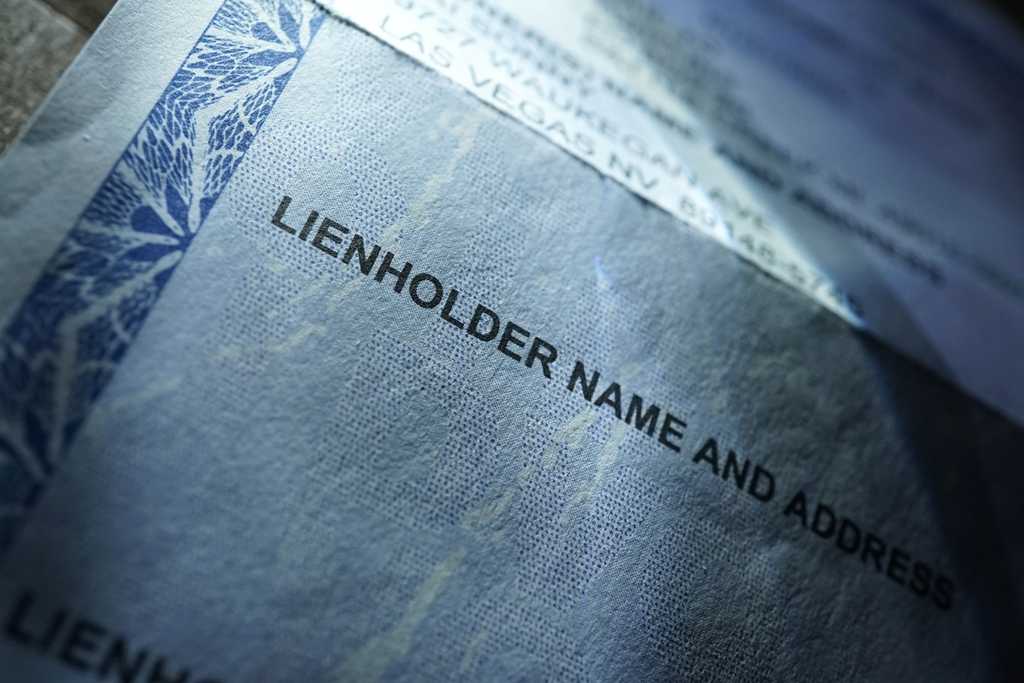

Every vehicle has a title, which is an official document from your state’s DMV that lists important details about your vehicle. Here is some of the information that can be found on a car title:

- VIN number

- License plate number

- Your name and address

- The make, model, and year of the vehicle

If you have an auto loan, your car title will also list the name of the lienholder and their contact information. By listing the lienholder’s information, it ensures that you cannot sell the vehicle until the loan is repaid, and the lienholder’s name is removed from the title.

How Does a Lien Affect My Car Title and Insurance?

There are a few ways that a lien can affect your car title and car insurance.

First, your lienholder’s information will be listed on your vehicle title. Until you repay the loan, the lienholder still owns the vehicle. This restricts you from certain things, like selling the car while you owe money on it. In fact, you won’t receive the official vehicle title until the lienholder’s name has been removed.

In terms of auto insurance, having a lien on your car means that the lienholder can require certain types of insurance. For example, many loan providers require drivers to carry a full coverage car insurance policy until they repay the loan. This provides an additional layer of protection for the lender in the event that your car is seriously damaged, totaled, or stolen.

How to Add or Remove a Lienholder From Your Car Insurance

Whether you just opened an auto loan or are getting ready to pay it off, adding or removing a lienholder from your car insurance policy is fairly simple.

To add a lienholder, you’ll go through your insurance company. Call an agent or log into your customer portal to add the lender’s information. You will need the name of the lienholder, as well as their mailing address and contact information. Verify that your insurance coverage meets the lender’s requirements. Then, ask your insurance company to send the lienholder a confirmation that their information has been added to your policy.

To remove a lienholder after your loan is paid off, you will need proof of repayment from the lender. You might receive this documentation automatically in the form of your vehicle title, or you may need to request a letter from the lender. Once you have proof of repayment, you can send it to your car insurance company who will be able to remove the lienholder from your insurance policy.

What's the Difference Between a Lienholder vs. a Loss Payee?

A lienholder and a loss payee are similar, but they aren’t exactly the same thing. A lienholder is the third-party that owns your car until the loan is repaid. A loss payee is the third-party who has the legal rights to an insurance payout if you have a claim.

Even though you are the named insured on your car insurance policy, you do not receive the payout if you have a covered loss, like vehicle damage after an accident. Typically, the loss payee is someone from your lending company, because they own the vehicle while you continue to pay off the loan.

Once your auto loan is paid off and the lienholder is removed from your car insurance policy, you will receive the insurance payout following a covered claim.