Below, I’ll cover some of the critical steps on how to get car insurance. By following these steps, you should be getting car insurance quotes in no time.

1. Gather Relevant Driver and Vehicle Information

The first thing you need to do before getting car insurance is to gather all relevant driver and vehicle information. Just like doing your taxes, it helps to have every bit of pertinent personal information handy to go through the application process quickly. Here are some of the things you should have ready:

- Your complete, legal name

- The full, legal name of the owner - if for some reason the owner is not you, or if drivers are a co-owner, you’ll need the other owner’s name

- Your date of birth.

- Your full address - wherever the legal address is in the state of wherever the car is registered

- Your driver’s license - you’ll need both the state it was issued in as well as your driver’s license number (this should be right on the front of your license)

- The VIN (Vehicle Information Number) - this is usually somewhere on your car, but you can also use this tool to look up your VIN

- The vehicle’s mileage - check your odometer and find the current mileage

- The vehicle purchase date - you’ll need the date you bought your car; if you can’t find it or can’t remember, you can use this tool (or contact the dealer or lender) to help

- The vehicle’s use - you’ll need to state whether you’re driving the car for personal use or work

What Paperwork Do I Need to Get Car Insurance Quotes?

Aside from the basic information I listed above, there is some additional paperwork you may need to have ready to receive car insurance quotes:

- Vehicle registration - your registration has to be current and registered under your name for the car you’re insuring.

- The declaration page of current auto insurance - the declaration page shows your auto insurance policy, rates, coverage, and more. A good rule of thumb is to save your declaration pages for two to three years.

- Voided check - some car insurers or insurance agents will require you to have a voided check if you’re paying for auto insurance using autopay out of a checking account

2. Read up on Your State’s Car Insurance Laws

In virtually all states, drivers are required to have a specific amount of both bodily injury and property damage liability insurance. These two types of auto insurance will cover the other party if you're involved in a crash that you cause.

The coverage amount in your policy depends on the policy itself (and, in this case, the state's requirement). In many cases, though, the state-required minimum isn't sufficient. If that's the case, you may be liable to cover the difference (which could be a substantial amount). So because of that, we recommend getting more coverage than the state requires.

Additionally, your state might require you to buy more car insurance coverage options beyond just basic liability insurance. A great example of this is underinsured/uninsured motorist insurance coverage. If you get into an automobile accident with somebody that doesn't have adequate car insurance (or doesn't have it at all), this kind of car insurance policy will take care of you.

Thus some states require it. You may also reside in what's called a "no-fault state." If so, you'll first have to get PIP - or personal injury protection insurance. This kind of car insurance policy will take care of the cost of your medical bills (and it also doesn't make a difference if you are at fault or not).

I've scratched the tip of the surface here. The key takeaway is that you absolutely MUST understand the specific rules for your state.

In most cases, a good car insurance company will handle this for you when you get a quote, but it's always good to be aware. And if you’re working directly with insurance agents, you can also ask about discounts (in addition to the rates for the policy you’d like to buy).

Remember that driving without car insurance in a state where it is required could have as severe a penalty as going to jail. So make sure you have not only enough, but the right, coverage for what the state requires and what you need, which I am going to cover in more detail below.

3. Determine Which Car Insurance Coverage You Need

Nearly every policy covers you and your family, other people, and your vehicle. Many different types of car insurance tend to fall within these three categories, but for the sake of keeping it simple, let’s focus on the big three.

Liability

The policy for other people is called liability insurance. So if you crash into somebody's vehicle, it's what you are liable for. Drivers are responsible for paying for their damages. So it'll cover property damage - their vehicle, if you hit their house, their mailbox, etc. It's going to cover the cost to either repair or replace that property.

The other piece of a liability policy is bodily injury. This one is pretty simple. You injured somebody. So they're medically hurt. Now in most states (except the ones requiring PIP), this will be the same.

About ten years ago, and even today a bit, the most common liability limit was 100,000/300,000. This means that your policy coverage covers $100,000 per person and $300,000 per accident.

Say, for example, I hit your vehicle, and you're injured. And your friend in the passenger seat is injured, too. With the policy I just mentioned, my car insurance will cover $100,000 per person in your vehicle, up to $300,000 total.

But costs have gone up over time. The most common policy coverages today (in most states) are 250,000/500,000. So if you injure somebody, it's going to cover $250,000 for each person, up to $500,000 per accident.

For most people, that’s typically enough. Be sure to check your state’s requirements and what you feel you need, however. This often isn’t a place to try and save too much money.

Comprehensive & Collision

For your vehicle, then, there are two pieces: comprehensive and collision. Comprehensive is where in most cases, the vehicle is not moving. Anything out of your control, such as weather damage, you hit an animal, someone vandalizes your vehicle, steals your vehicle, etc. That's comprehensive. In most cases, cost-wise, it's not expensive to carry.

Collision, on the other hand, is what it sounds like – coverage for a collision. This helps cover the cost of repair or replacement to your vehicle. Say, for example, you have a $500 deductible.

That means if you’re in a crash and it's your fault, you’re going to pay $500 toward the claim. The car insurance company will cover whatever the rest of the value of your vehicle’s repair or replacement is.

What is Full Coverage?

When someone says they want “full coverage,” they're telling you they want all three of these coverages. They want a policy for themselves and their family, for other people, and for the vehicle.

Other Types of Car Insurance to Understand

When getting insurance quotes, there are a few other types of car insurance you should know about:

- PIP - Personal injury protection is required when driving in some states. It can help cover the cost of medical bills if drivers are in an accident.

- Uninsured/underinsured - Covers you if you get into an accident with someone who doesn’t have sufficient auto insurance or doesn’t have auto insurance at all.

- Medical payment - Medical payment coverages are required for driving in some states. Like PIP, it will help cover the cost of medical bills when drivers are injured in a vehicle accident.

- Rental reimbursement coverage - If you get into a crash and need to get a rental, this will cover that rental cost (for a certain amount of days and up to a certain dollar amount).

- Gap coverage - Gap coverages help you pay off your loan if it’s totaled in a crash (or it’s stolen), and you happen to owe more on the loan than the car is worth.

- Towing and labor cost coverage - This covers the cost of towing your vehicle and any associated labor costs. If you have AAA or another form of policy protection like roadside assistance, you can probably skip this.

- Ride-sharing coverage - Believe it or not, you can get policy protection for ridesharing like Uber (many people do this instead of driving a rental). Just ask your auto insurance company about this.

4. Decide on Premium and Deductibles You Want

Before you decide you get a car insurance quote, it’s important to know how premiums and deductibles work. The deductible is your portion of a claim. So if a driver has a covered accident and they’re filing a claim, the car is getting fixed. It's how much you have to pay to get the car fixed. You get to choose what level of deductible you want.

Note that you also may be eligible for insurance discounts to help you save money when you get a quote for your various coverage options.

This depends on the agent you’re working with (and if they’re independent and cover multiple insurers or work for just one insurer), their current rates and policies, and if you have policies with them already (say, for homeowners).

It’s always good to ask about insurance discounts when you’re applying for coverage options - regardless of who you’re working with.

The way that that works is you have comprehensive coverage. It’ll range anywhere from $0, all the way up to $1,000 deductible. You can go to $1,500 with some auto insurance providers, but it's kind of pointless to go that high.

A typical deductible, especially if you’re unsure or just getting started, is between $100 and $500. Now, there's a good and a bad to this level deductible. Still, first, I want to explain how the deductible impacts your premiums.

How Deductibles Impact Your Car Insurance Quote

Paying a higher deductible affects the premium because the insurance has a risk profile, and you're paying a premium for that type of risk. This includes things like where you live and the type of driver you are (i.e., if you have any tickets or accidents). All of that up adds up to be your risk profile.

So with a deductible, you're taking out a portion of the total risk and saying you will effectively pay part of the cost in case of an accident. In turn, the auto insurance company will then lower your premiums because you save them some of that risk.

And it's not just the fact that you're taking that risk. It's the people that pay those deductibles and take that portion away. The higher it is, the more they're willing to pay, which shows partial responsibility. This in turn will impact your rates.

5. Find Out Where to Get a Quote

Now that you understand the basics, let’s talk about where you can actually get a quote. There are really three options:

- Online

- Over the phone

- From a captive agent

- From an independent agent

Getting a quote online is probably the easiest (and fastest) way to get a car insurance quote, but it may not always yield the best results. Doing it over the phone is similar, but you’ll have to talk to a live person and you may not be able to see everything in front of you.

The alternative is to use an agent. A captive agent is one that works directly for a single insurance provider. An independent agent is able to sell insurance from a variety of different insurers, which tends to give you more options.

Now let's dive into each of these in more detail.

Auto insurance quotes online or over the phone

As I mentioned, getting a quote online (and even over the phone) is usually fast and simple to do. Between the two, I’d suggest doing it online since there are so many options and it’s far easier.

When you get a quote online, say for example with State Farm, they make the process streamlined for you. There’s no pressure to buy a policy and you can adjust your policy details to see a variety of pricing options.

On the downside, you’ll most likely have to enter your name and email address (at least), and probably your phone number too. This means you’re going to get an abundance of follow-up correspondence from the company - so be mindful of that.

Also, there’s usually a disclaimer that says the quote is just an estimate and it’ll reflect more accurately once you actually apply for coverage. In that case, you may end up with a different price than you’re quoted.

Insurance Agents

Another option for getting a quote is to work directly with an insurance agent. As I mentioned, there are two main types of auto insurance agents you can work with - captive and independent.

Captive Insurance Agent

A captive insurance agent is a representative of a certain insurer. To use my State Farm example, you might see a local State Farm branch with someone listed as the agent.

Eric Martinez is the State Farm agent. He’s a captive agent, meaning he will only be able to sell you State Farm products and services.

The upside is that captive agents tend to know everything about their company’s products and services. It’s what they deal with every single day. You’re also able to develop a more personal relationship with that agent, who you can call for any insurance needs you have.

The biggest downside, though, is that you only get options from a single insurer. You can’t really compare against other insurers, only other products within that same insurer. And, if you don’t have a good relationship with the agent, they may try to upsell you on additional products and services (I mean, it’s their job).

Independent Agent

An independent agent, or broker, then is someone who can sell you a variety of insurance products from a variety of insurers.

This obviously opens up your options to the type of products and services you can get, as well as the insurer you get them with. So overall, there tends to be more options to choose from. The downside is that most brokers will charge a fee, as they work on commission. So you may not always get the best options presented to you every time.

6. Start Comparing Quotes

Comparing quotes is absolutely pertinent when you’re getting car insurance. In fact, I recommend comparing at least three to five different quotes before making a final decision. So much depends on where you live, your age, the type of car you drive, your gender, and more. So it makes sense to ensure you’re getting the best deal (and the right coverage) before signing up.

If you’re using an agent, it’s fairly easy to compare quotes, as they’ll do this for you. What you want to make sure of, though, is that you’re not getting more coverage than you actually need.

To give you a personal example, I switched from State Farm to Geico several years ago after I realized State Farm (I was using a captive agent) was charging me more than double what Geico was. I just needed to do a little research on my own.

The same goes for independent agents. Make sure you look closely at the amount of coverage they’re offering and saying you need - it might not always be the best option for you.

The best way, however, to compare quotes is online with a car insurance aggregator like Policygenius.

Policygenius doesn’t sell insurance directly, but instead they connect you to a variety of other insurers and help you compare quotes quickly. Once you find an option that fits you, you can apply directly with that insurer, and Policygenius gets a fee for referring you.

I’ll show you how this works so you can get a sense of how simple it is.

Comparing Quotes Online with Policygenius

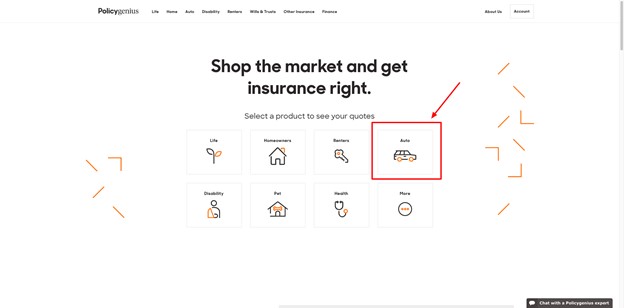

To start, head to Policygenius.com and choose the type of insurance you want to compare. In this case, we’ll select “Auto”:

From there, you’ll land on the Car Insurance page. Just click “Get auto quotes” at the top:

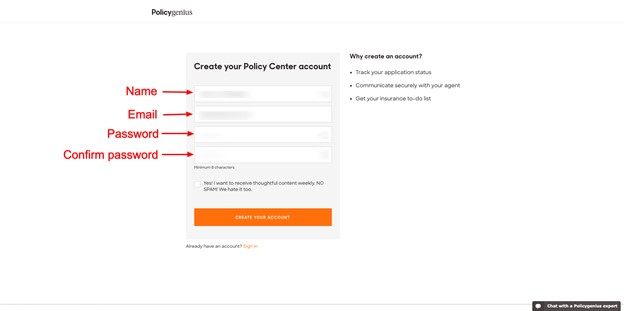

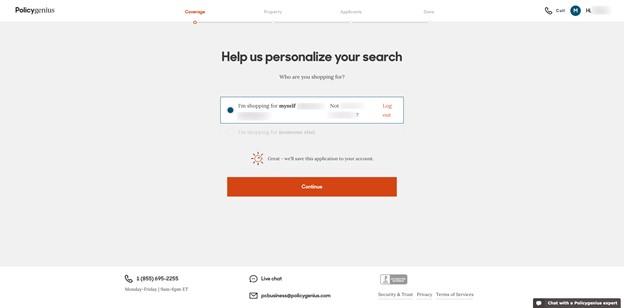

After that, Policygenius will tell you how their process works, and you will click through to start the questionnaire.

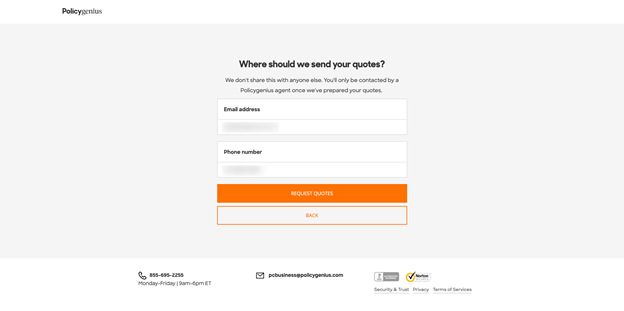

Once I confirm my coverage, I will enter my phone number and email address to have quotes sent directly to me within 48 hours:

The entire process took me about 10 minutes (including creating screenshots, which you obviously won’t have to do).

Alternatively, you can go to an insurer directly, like Geico, and get a rate quote from them within minutes. You can compare different options and buy a policy right away. The downside is that you can’t easily compare apples-to-apples across different insurance providers.

To summarize, it’s helpful to get at least three quotes online before making a final decision.

FAQs

How do I get car insurance for the first time?

To get auto insurance for the first time, gather all the necessary paperwork and information and get a free car insurance quote online with an insurance company or with an insurance agent to compare your options. From there, you can select an insurer and proceed with an application to be insured in no time. Note that any free online quote you get will be for informational purposes until you formally apply.

How much does it cost to start auto insurance?

The cost to start auto insurance varies on several factors, including where you live, your age, gender, and the car you drive. The best option to get an accurate price on an insurance policy is to get a free car insurance quote from an online auto insurance company, or an insurance agent, and compare your options. Additionally, look for things like safe driver discounts to lower the cost.

Final Thoughts

Getting auto insurance might seem complicated, but it’s pretty easy once you have all the necessary information. Just follow the steps I’ve outlined above and choose an auto insurance provider that fits your needs. It may also help to find an insurance agent so you can field several different quotes at once. Either way, by doing this, you should be insured before you know it.